One of the questions I get asked quite a bit is – can you buy life insurance on your parents? I get this question for a variety of reasons but the number one reason is that the parents don’t own any life insurance.

One of the questions I get asked quite a bit is – can you buy life insurance on your parents? I get this question for a variety of reasons but the number one reason is that the parents don’t own any life insurance.

In this article, I’m going to talk about the in’s and out’s of buying life insurance for your parents. I’ll also discuss the mistakes I see people make in dealing with their parent’s life insurance.

Here’s a link to my guide to life insurance for other life insurance questions.

Can you buy life insurance for your parents?

First, let’s answer the main question about whether you can try to get life insurance for your parents. The answer is yes you can, but you can’t do so with their knowledge and without their consent.

Although there are exceptions to this rule, insurance companies require the person being insured to sign the application. This is how insurance companies obtain consent. It also gives them the permission to look at medical records.

This means you can’t buy life insurance on your mom or dad without them knowing. If your parents won’t (or can’t due to disability) sign the life insurance application, then you’ll be out of luck.

This means you’ll need to talk to your parents about why you want to buy life insurance on them. In most cases, parents are not necessarily against getting life insurance if it’s needed. What they are usually against is paying for it.

Assuming your parents aren’t concerned you just want to knock them off for the insurance money, most parents will provide their consent if they don’t have to pay the premiums.

However, once you have their consent, the next hurdle is that you have to show the insurance company that you have an insurable interest.

What is an insurable interest?

Before an insurance company will let you buy life insurance on someone else, you have to show that you have an insurable interest.

An insurable interest is when you stand to lose financially if the person you want to insure dies. While having an insurable interest is more closely tied to insuring property, it does connect to life insurance as well.

Insurance companies won’t allow you to buy life insurance on strangers who have no connection to you. Besides the risk of fraud insurance companies would face of people killing people for the insurance proceeds, you stand to gain – not lose money – insuring someone you don’t have an insurable interest in.

Here are some examples of what an insurable interest looks like:

- Yourself: You always have an insurable interest in yourself.

- Husband and wife: If both the husband and wife rely on each other’s income and would suffer financially if one died, it’s an insurable interest.

- Children: If you have kids, you have an insurable interest if something happens to them.

- Business partnerships: If you own a business with another person and would need money if they died to continue the business, you have an insurable interest.

- Key employees: Business often rely heavily on key employees who are essential to making the business financially successful. If the business would suffer a financial loss if that employee died, there’s an insurable interest.

Surprisingly, I know of county governments who buy life insurance on their K9 dogs because the county would suffer a financial loss of having to find and train another K9 for law enforcement.

Now you know what an insurable interest is.

The key point here about insurable interest is that it’s the owner of the life insurance – not the person being insured – who has to show that there is an insurable interest.

Whenever the owner is different than the insured on a life insurance application, the insurance company is going to ask is there an insurable interest?

But, because the owner has control of the policy, this provides an easy way to buy life insurance on someone else and not have to worry about proving insurable interest.

How to get around insurable interest when buying life insurance on a parent (or someone else)

The owner of a life insurance policy controls the policy. This allows the owner the right to do certain things like name whoever they want as beneficiary for example.

One privilege all owners have is the right to transfer ownership to another person.

This means that if you want to buy life insurance on your parents or someone else for that matter, they should apply for the policy as the owner and insured.

Once the policy is in place, the owner can transfer the policy to someone else even if that person doesn’t have an insurable interest.

Now that you know you can buy life insurance on your parents, let’s talk about some reasons why you want to do that.

Reasons to buy life insurance on your parents

Having talked with thousands of people over years, I have heard many, many, many people say their parents didn’t believe in life insurance. Unfortunately, when their parents died, they got stuck with the bill from the funeral home.

Those that have had to pay out of their own pocket for the funerals of other family members certainly see the need for at least some life insurance. Because of that, they say they buy life insurance on themselves so their kids won’t get stuck with the same problem.

So let’s talk about some of the reasons you might want to buy life insurance on your parents. Here is a list of reasons why you might considers it.

- Funeral expenses The most obvious reason is that when anyone dies, there still will be funeral or other final expenses related to passing away.

- Financial support for a surviving spouse If both parents are still living, if one parent dies, the surviving parent may still need income.

- Care for family members Even older parents might still have family members who rely on them for financial support. For example, these days, many older parents are taking care of young grandchildren. However, parents still might support adult children financially or pay for specialized care for other family members who need it. Many other grandparents also need life insurance for grandchildren in case the worst happens and a grandchild dies.

- Provide a survivor benefit Parents may opt for a larger retirement benefit and chose to provide their spouse a survivor benefit through outside life insurance instead of inside their pension.

- Replace the life savings spent on medical expenses or long term care These days, health care expenses are through the roof and if you need long term care, prepare to be shocked by the monthly cost. Instead of just transferring a lifetime of wealth to health care system, you can retain that wealth in the family with life insurance. I’ve been told numerous stories by those who have blended families that their savings was used for a second spouses care and inheritance for their family instead of their rightful children.

- Pay taxes or other debts Parents could have other liabilities like taxes, mortgages and other debts that might need to be paid in order to retain assets in the family.

- Pass on a larger inheritance An often overlooked feature of life insurance is passing on a larger inheritance to their family by using cash that is just sitting there and would never be needed for support.

- Plan for chronic illness Long term care is a tough reality for most families with no way to pay for it. Many life insurance policies can have chronic illness riders that can provide cash for such expenses.

Those are just a few of the reasons that you might want to buy life insurance for your parents.

However, the number one need is most likely going to be for funeral expenses.

After that, it’s primarily a question of how much you want to spend.

How much does life insurance cost for parents?

How much life insurance will cost for your mother or father will depend on what type of life insurance you decide to buy and a bunch of other factors. The age and health of your parents is the biggest factor on what the rates would be.

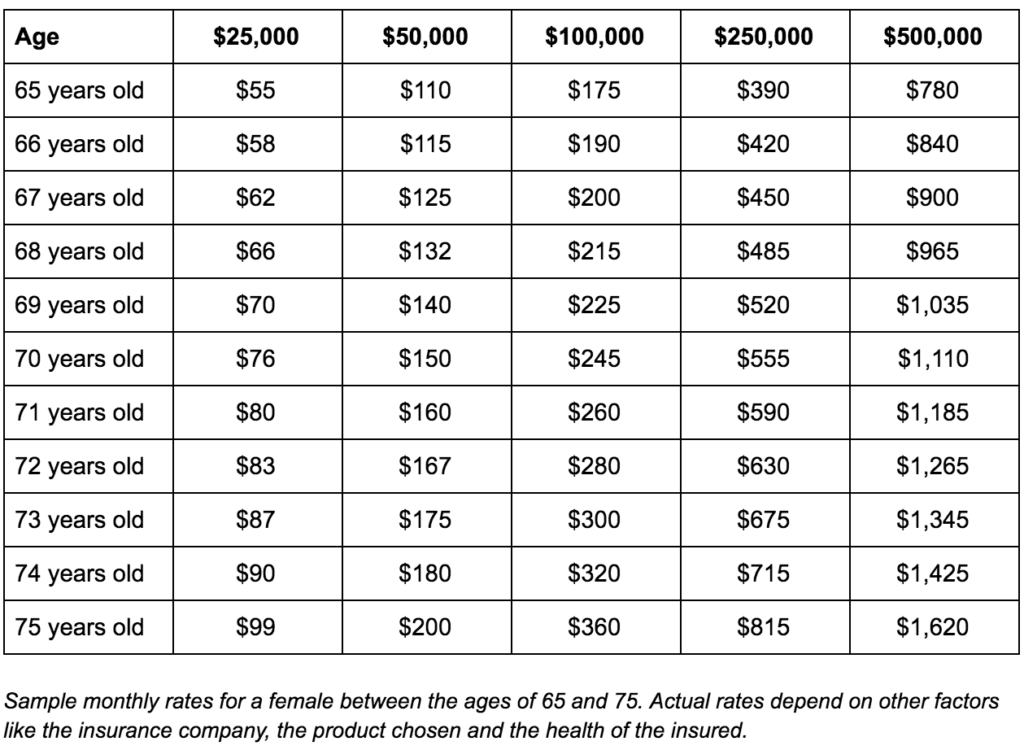

To give you some idea of the cost involved, I surveyed a few insurance companies and averaged out the costs from a few insurance carriers.

Keep in mind these rates are for permanent life insurance policies and not term life insurance. The reason why is because term life insurance policies expire at certain ages. You don’t want the policy to expire before one of your parents needs it most.

Be careful when surveying rates. Realize that some sites on the internet will provide term insurance rates instead of permanent life insurance rates.

Also realize that the rates here are probably low, since your parents health will likely not be good enough to get the best rate available.

With that in mind, here’s a sampling of rates for ages 65-75 and amounts between $25,000 to $500,000.

Hopefully, if you decide to pick up some life insurance for your parents, you’ll get a rate you that can afford.

Once you apply for life insurance on your parents, though, you’ll find out your real rate if your parents can qualify for coverage.

But what if they can’t qualify for life insurance then what do you do then?

What if your parents are denied life insurance?

It’s difficult to get life insurance for sick parents and if your parents over 80 they won’t qualify life insurance due to their age. If they get denied for life insurance because of health, here are a few things you can try.

- Group term life insurance conversion If your parents are still working, they might have a group life insurance conversion option through their employer to a permanent life policy without medical questions.

- Guaranteed issue policies offered through your parents employer If your parents are still working, they may have the ability to enroll in a permanent life insurance policy they can keep after they leave work without having to answer any medical questions.

- Work with an independent agent Not all insurance companies are the same. If you work with an independent agent who can work with multiple insurance companies, you can try applying at another insurance company.

- Apply for a guaranteed issue policy A privately bought guaranteed issue policy doesn’t require answering any medical questions or taking a medical exam. Depending on the offer, a guaranteed issue policy may have a limited death benefit for the first two years. This means that if your parents die before the limited benefit period ends, the death benefit will not be paid out.

- Prepay funeral arrangements You can often prepay for funeral expenses. You would need to contact the funeral home of your choice to learn more.

- Insurance of last resort: Buy an accidental death policy if under your parents are under age 70 One additional thing you can do if your parents are under age 70 and can’t qualify for life insurance is to buy an accidental death insurance only policy. Just realize that the likelihood they will die in an accident is extremely unlikely. Also, once they are over age 70 coverage will probably terminate. These two factors probably mean that the accidental death policy won’t ever pay.

One thing that is easy to fall for are no medical exam life insurance policies. Remember, no medical exam is not the same as no medical questions. It’s not the same as a guaranteed issue policy where no medical questions are asked.

I get offers for life insurance in the mail all the time that say no medical exam but when you read the fine print, it states they won’t approve you if you have a history of a list of medical questions.

The problem with those plans is that you could pay for coverage for years and then later learn the insurance company won’t pay because you didn’t read the offer carefully.

That’s one of a list of mistakes that many people make when putting together a life insurance plan for their parents.

Let’s discuss some of those.

Ten common mistakes made with your parent’s life insurance

It’s easy to get confused about how life insurance works and make mistakes.

- Buying term life insurance for funeral expenses With older parents, you need permanent coverage for funeral expenses – not term life insurance. Term life insurance expires and it usually expires worthless because your parents will probably outlive it. That won’t do you any good if you need to pay for their funeral at an age after the term has already expired.

- Buying universal life insurance Universal life insurance is cheaper but can (and does more often than you’d think) expire before you die if it’s underfunded. And, one of the problems with universal life insurance is underfunded premiums. You are better off buying a whole life policy with guaranteed premiums, face amounts and cash values. While you can buy a universal life insurance policy with a no lapse guarantee, your cash value wouldn’t be a guaranteed. That means if you need access to your cash value, you’ll run the risk of the policy lapsing if you take out the cash value. Chance are good though that the older your parents are, the more likely that cash value will be eaten up by higher mortality charges anyway.

- Buying a graded benefit policy or an accidental death policy when your parents would qualify for a regular life policy Accidental death policies are cheap because they rarely pay out. If you parent can qualify for an ordinary life insurance policy, you want to choose that over an accidental death policy.

- Lying or overlooking medical questions to get a policy Not being truthful on an insurance application gives the insurance company an out when it comes time to pay. You only want to buy life insurance for your parents that you know will pay out for sure. Otherwise, you are wasting your money. Read every offer and contract carefully to make sure you know how it works.

- Not understanding how graded benefit insurance policies work Sometimes people get graded benefit policies. Graded benefit policies limit the death benefit for the first couple of years. If your parents die in the first two years of the contract, the life insurance won’t pay a death benefit. That’s fine if you are aware of how it works but not if you really don’t. Read your contracts to know for sure what the limitations are so you don’t get surprised.

- Relying on parent’s group term insurance at work Most people feel like they will live forever and always have the group term life insurance where they work. But, almost all group term life insurance contracts have a built in age reduction schedule that lowers the insurance once you reach older ages. Plus, the moment you leave employment, it will probably terminate. While group term life insurance may be converted to a permanent life insurance policy if you can’t get life insurance any other way, most people let that option expire without checking into it.

- Parents owning their life insurance in their own name When parents own their own life insurance, it’s one of their assets. The problem with this is that if they need long term care, the medicaid rules will basically steal their permanent life insurance. Get some legal advice and determine if you should own the policy or put it in a trust of some sort.

- Transferring ownership on a policy that has cash value If you transfer a life insurance policy with cash value to another person, you could inadvertently make the life insurance proceeds taxable under what are called transfer for value rules..

- Cashing in your parent’s policy A lot of kids cash your parent’s policy in to take the cash value when the face amount that would be paid out is much higher and also tax free.

- Forgetting about additional riders included on the base policy As years go by, it’s easy to forget about the additional types of insurance riders that might be included on a policy. Riders such as a chronic illness rider can help offset the costs of long term care. Unfortunately, most of the riders get forgotten are left unused.

Those are a few of the mistakes that children make with their parents life insurance.

Conclusion

You can buy life insurance on your parents as long as they qualify and you can afford it. The primary reason to think about getting life insurance for your parents is to pay for their funeral expenses when they die.

Let me know in the comments your experience in buying life insurance for your parents. If I can help you with anything or have any other questions, let me know in the comments as well.

Leave a Reply