The life insurance age reduction schedule is a group term life insurance provision. It reduces the face amount of your group life insurance when you reach certain ages like 65 or 70.

It’s not unusual for an employee to first learn about this reduction at the age it first reduces. Details about how most age reduction schedules work and what you want to watch out for are below.

I also made this video that talks about group life insurance age reduction schedules.

RESOURCE: If you need a refresher on how group term life insurance works, start with The Complete Guide To Group Term Life Insurance.

What is the Life Insurance Age Reduction Schedule?

The age reduction schedule reduces the face amount of your group term life insurance. The reduction will occur if you are still working when you reach certain older ages. The most common age face amount reductions begin is at age 65 or 70.

It’s there because it costs more to insure older individuals than younger ones. Instead of raising the premiums, they lower the amount of the life insurance if you are older.

When Does the Age Reduction Schedule Start to Reduce My Life Insurance?

When reductions start depends on the provisions in the group certificate. In general, these face amount reductions start at around 65 years or 70 years old.

I can’t say for sure if your plan has an age reduction schedule. Every plan is different. I would need to look at your employer’s group certificate to see for sure. I can say it’s likely your employer’s plan has a life insurance age reduction formula built in it. But like everything with group insurance it will depend on what the actual contract says.

An Example of How the Life Insurance Age Reduction Calculation Works

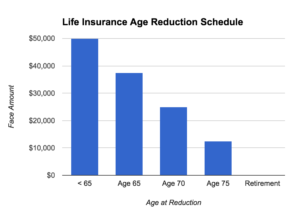

As I mentioned, the age reduction schedules will vary from plan to plan. Here is a sample schedule that begins at age 65.

At age 65: 25% reduction in life insurance

At age 65: 25% reduction in life insurance- At age 70: 50% reduction in life insurance

- At age 75: 75% reduction in life insurance

- Benefits end at retirement

Where to Find the Age Reduction Schedule in Your Employer’s Group Term Plan

It’s also not uncommon to find out that nobody knows what the schedule is when you ask for it. That’s no surprise when it happens.

The best place to find the schedule is in the group certificate. Your employer should have a copy of it.

- Insurance carriers can change. It’s not unusual for group term life insurance carriers to change from one year to the next. So remember, the age reduction schedule might be different when you get older.

- Every group plan is different. Group term life insurance plans vary from employer to employer. Check with each employer you work for to see how it works.

- Group term life terminates. At some point, your group term life insurance expires anyway. That might be when you leave employment or at a certain age even if you are able to “port” it.

- Spouse rules may be different. Rules on spouse age reductions may not match the employee. If you have your spouse covered under a group term life plan, you’ll want to know how it works for them as well.

Term Life Insurance Isn’t Meant to Last Forever So Don’t Expect It to Be There When You Need It

Group term life insurance is only designed to last for a certain period of time. It’s not supposed to last for your whole life. So, there’s a good chance you’ll outlive the group term life insurance and it won’t be inforce when you die.

If it was likely to be inforce when you die, then it would cost a lot more for everybody covered under the plan.

Conclusion

I’ve seen employees pretty upset that no one told them their life insurance at work would reduce. Had they known it would happen, it might have been easier to buy some whole life insurance. They would have been younger and could have been healthier.

So now you know that the age reduction schedule is out there and it’s something you can plan for. It’s a good idea to have at least enough permanent life insurance for your funeral.

Permanent life insurance may last your whole life.

The age reduction schedule is one of eight problems with group term life insurance.

Does your employer’s plan have an age reduction schedule?

Let me know how it works in the comments below. Let me know if you have any questions as well.

Question: Generally you pay for the amount of coverage based on your age bracket. Will the premium-cost of insurance also be reduced according to the reduced amount?

Yes. You’d pay the cost per thousand for your age group for the amount of insurance inforce. Keep in mind other products like group critical illness coverage, for example, might work differently. In group critical illness, it’s not uncommon to cut the benefit in half at a certain age but still keep the premium the same as it was before the age reduction.

Does group term life qualify for living benefit

If you mean accelerated death benefit, then yes, it can and often does.

My wife turns 70 next month, Dec. 2019. My UltiPro is telling me that she will not be eligible in 2020. Why is this and what happened to all of the premiums I have been paying for the last five years?

If your wife was covered under your group term life insurance plan where you work it is possible her coverage might have ended at age 70. I would check with your HR department to verify. This would not be unusual because the rules on spouses can and often do work differently than for the employee. As far as the premiums you have paid for the previous five years, that paid for the coverage for each of those years. Had she died during that time, the insurance company would have paid the life insurance benefit to you. It sounds like she has outlived the term (or time period) of the group term life and the premiums you paid were the cost of the insurance during that time and there is no cash value to group term life insurance you can get back.

This makes a lot of sense for group term, but what about supplemental group term? For example if the age reduction is 50% at age 70 and the employee who is 69 at the time of open enrollment elects $50,000 in supplemental life coverage. They would pay for $50,000 throughout the year until they turn 70 mid-year at which point the coverage reduces to $25,000. Can’t they just elect to go back up to $50,000 at the next open enrollment or elect to go up to $100,000 knowing it’s just going to be reduced by 50% down to $50,000? It seems very odd to decrease the coverage when it is an employee chosen amount. Any insight would be helpful.

Basic group term (employer paid) and supplemental group term often both have age reduction schedules. Remember that this coverage is not owned by the employee and not meant to be “permanent” coverage. Previous coverage that is age reduced can be increased but usually requires evidence of insurability and approval by the insurance company. Whether the coverage can be increased would depend on whether the employee could qualify for it but it could be done if within the plan limits and the employee is healthy enough to be approved. Most employees don’t though because of the increased cost.